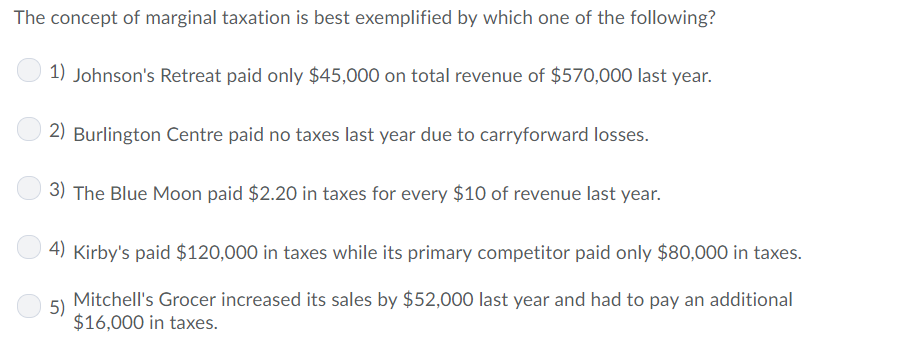

The Concept Of Marginal Taxation Is Best Exemplified By Which One Of The Following?

The concept of marginal taxation is best exemplified by which one of the following?. 2 Burlington Centre paid no taxes last year due to carryforward losses. What Is Marginal Tax Rate. Households less than the average pay the average tax rate.

Asked Apr 29 in Business by jennifer_pringle. Mitchells Grocer increased its sales by 52000 last year and had to pay an additional 16000 in taxes. A tax is a compulsory payment made by individuals and companies to the government on the basis of certain well-established rules or criteria such as income earned property owned capital gains made or expenditure incurred money spent on domestic and imported articles.

Kirbys paid 120000 in taxes while its primary competitor paid only 80000 in taxes. The marginal tax rate is the tax rate paid on the next dollar of income. The concept of marginal taxation is best exemplified by which one of the following.

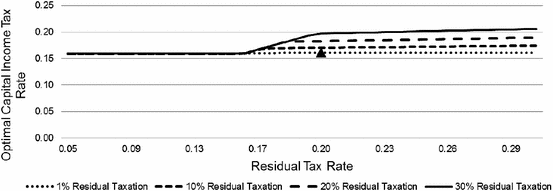

Average tax rates measure tax burden while marginal tax rates measure the impact of taxes on incentives to earn save invest or spend. Kirbys paid 120000 in taxes while its primary competitor only paid 80000 in taxes. What principle of American democracy is exemplified when people vote obey the law serve on juries keep informed about current issues or volunteer for social services.

Entire tax bill of the government in one form or another. Under the progressive income tax method used for federal income tax in the United States the marginal tax rate increases as. The average tax rate is the total amount of tax divided by total income.

A system in which average tax rates are higher than marginal tax rates is called. Marginal tax rate is the rate at which an additional dollar of taxable income would be taxed. Asked Apr 29 in Business by jennifer_pringle.

Which one of the following indicates that a firm has generated sufficient internal cash flow to finance its entire operations for the period. Johnsons Retreat paid only 45000 on total revenue of 570000 last year.

Kirbys paid 120000 in taxes while its primary competitor only paid 80000 in taxes.

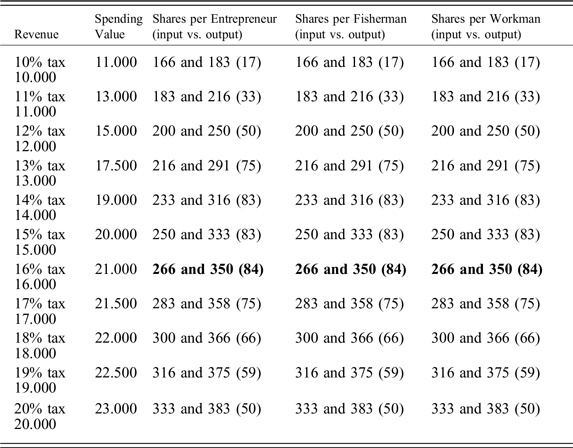

What principle of American democracy is exemplified when people vote obey the law serve on juries keep informed about current issues or volunteer for social services. Under the progressive income tax method used for federal income tax in the United States the marginal tax rate increases as. It is defined as the amount of tax you pay on any given dollar of income. Johnsons Retreat paid only 45000 on total revenue of 570000 last year. Johnsons Retreat paid only 45000 on total revenue of 570000 last year. E The marginal tax rate is the tax you pay on your last dollar earned while the average rate is the overall proportion of income paid in taxes. 3 The Blue Moon paid 220 in taxes for every 10 of revenue last year. Asked Apr 29 in Business by jennifer_pringle. The concept of marginal taxation is best exemplified by which one of the following.

In the world there are good reasons why lump-sum taxes are rarely used. As income rises it is taxed at a higher rate according to the marginal tax bracket it falls in. For example if a household has a total income of 100000 and pays taxes of 15000 the. 3 The Blue Moon paid 220 in taxes for every 10 of revenue last year. A system in which average tax rates are higher than marginal tax rates is called. Under the progressive income tax method used for federal income tax in the United States the marginal tax rate increases as. A lump-sum tax accomplishes exactly what the social planner wants.

Post a Comment for "The Concept Of Marginal Taxation Is Best Exemplified By Which One Of The Following?"