Contract For Deed Tax Treatment

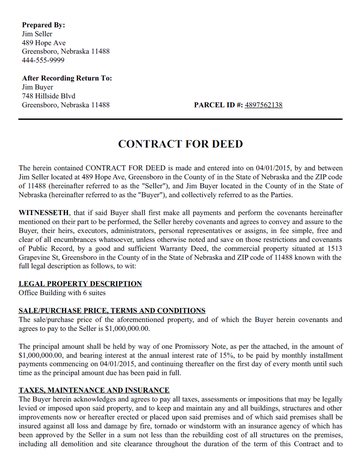

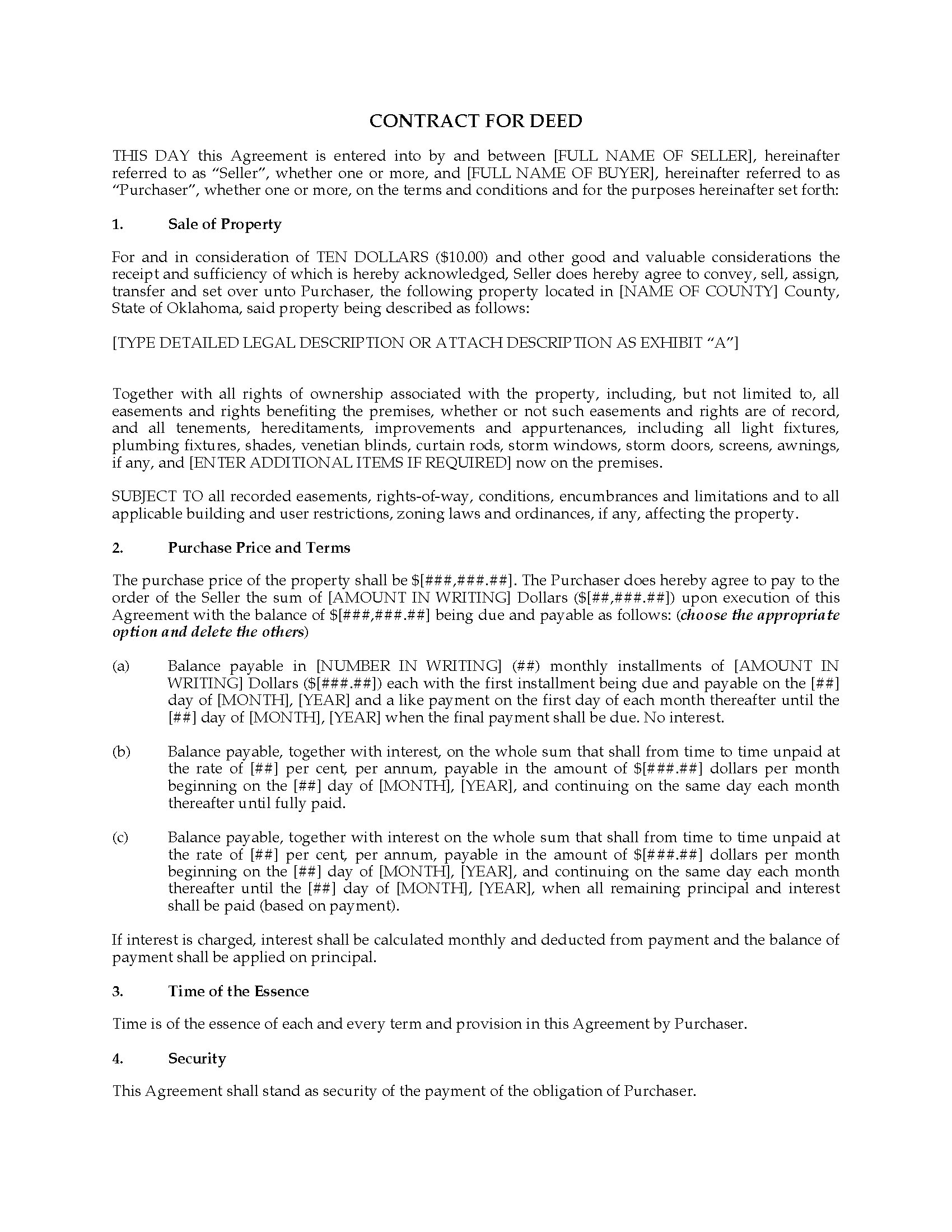

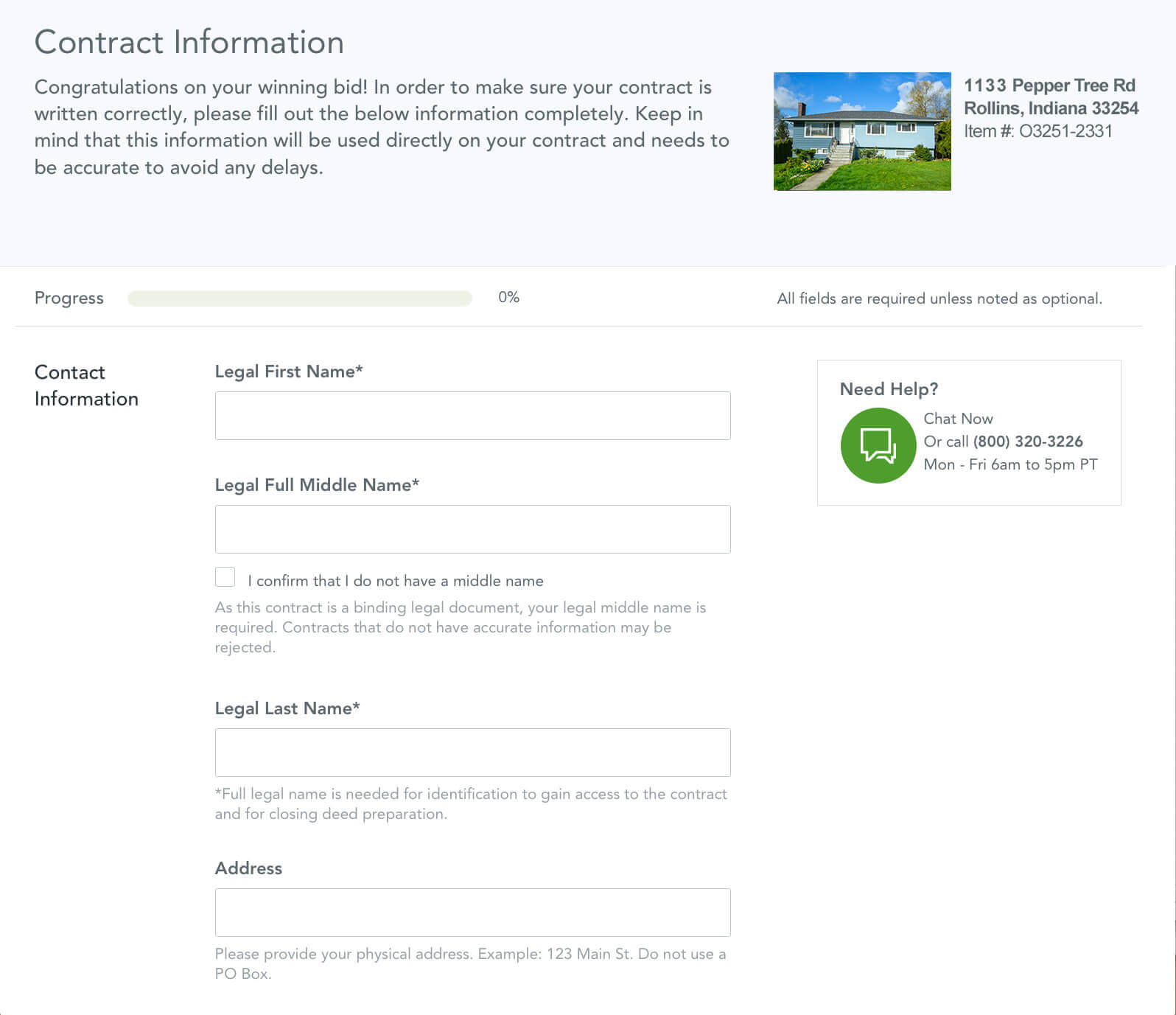

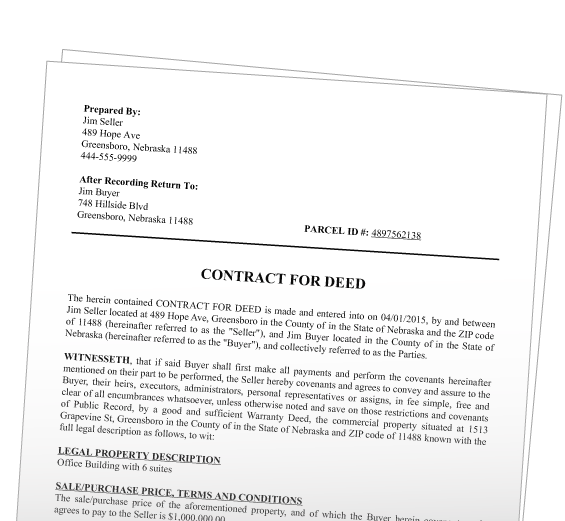

Contract for deed tax treatment. The contract stated that the 14 million would be payable on an installment basis until 2014 at which time the remaining balance would become due and payable. A Contract for Deed also known as a Land Contract is used when a seller finances a property for a buyer. This is necessary because no.

The IRS generally treats a contract for deed as a sale which means the buyer has the tax benefits of ownership. You can also deduct any real estate taxes. Thus the payments of interest that are made by the buyer in possession are deductible as mortgage interest even though the buyer does not have legal title to the property.

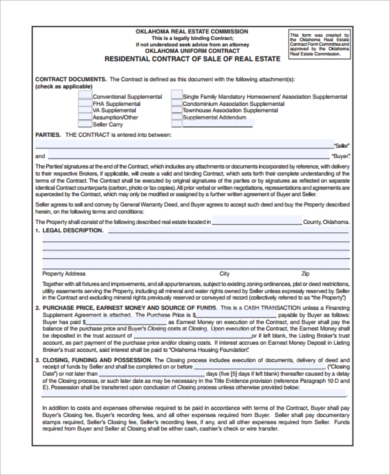

No Mortgage Registration Tax MRT is due on the recording of a contract for deed because a contract for deed is exempted under the MRT law. A contract for deed is an agreement for buying property without going to a mortgage lender. May 2008 Tax Deeds of Indemnities.

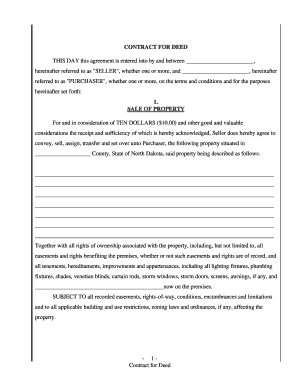

It is simpler and cheaper than getting a mortgage yourself but it isnt risk free. The buyer agrees to pay the seller monthly payments and the deed is turned over to the buyer when all payments have been made. The buyer instead of using a bank to finance the property enters into an agreement that works the same as a home loan.

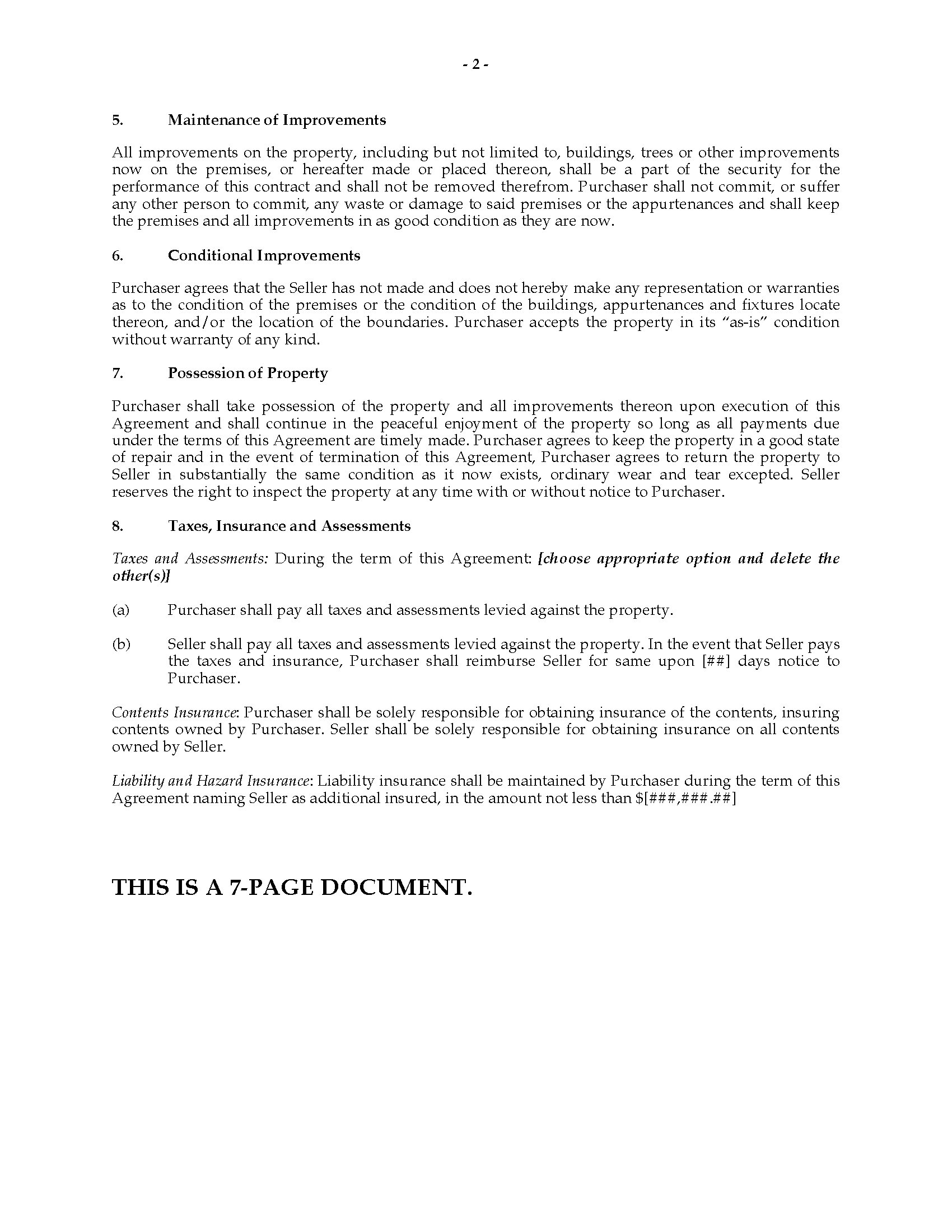

Structuring a tax deed is to first split the The common sense approach which is generally adopted as a result a payment to the buyer as opposed to the target company will be treated by Revenue as a reduction in the consideration receivable by the seller and that payable by the buyer. The Deboughs excluded 500000 of the 657796 gain under IRC 121. Good contracts for deed always fully detail buyer and seller rights and responsibilities concerning the property.

You do this on Schedule A making sure to write in the sellers name address and Social Security number. The seller does not have to report your contract payments to credit bureaus so on time payments are not improving your credit. In 2006 they agreed to sell the property on a contract for deed of 14 million.

This arrangement is convenient for buyers without access to credit and for sellers who wish to expedite the transaction. The IRS does allow you to deduct the interest portion of the payments you make under a contract for deed from your income taxes if you itemize deductions.

The gross profit percentage is 20 5000 gross profit 25000 contract price.

The gross profit percentage is 20 5000 gross profit 25000 contract price. The Deboughs excluded 500000 of the 657796 gain under IRC 121. A contract for deed can be a bridge to home ownership if the contract is fair. May 2008 Tax Deeds of Indemnities. In 2020 the buyer defaulted and you repossessed the property. In 2018 you included 1000 in income 20 020 5000 down payment. A Contract for Deed also known as a Land Contract is used when a seller finances a property for a buyer. A contract for deed is an agreement for buying property without going to a mortgage lender. Once sold the seller cannot claim depreciation or any other tax.

You can also deduct any real estate taxes. A contract for deed can be a bridge to home ownership if the contract is fair. Structuring a tax deed is to first split the The common sense approach which is generally adopted as a result a payment to the buyer as opposed to the target company will be treated by Revenue as a reduction in the consideration receivable by the seller and that payable by the buyer. In 2020 the buyer defaulted and you repossessed the property. Contract for Deed Information A contract for deed sometimes called a land contract or agreement for deed is a private mortgage between a buyer and seller on a piece of real estate. In 2006 they agreed to sell the property on a contract for deed of 14 million. A contract for deed seller must report the transaction as an installment sale on form IRS Form 6252.

Post a Comment for "Contract For Deed Tax Treatment"